Dear Sara,

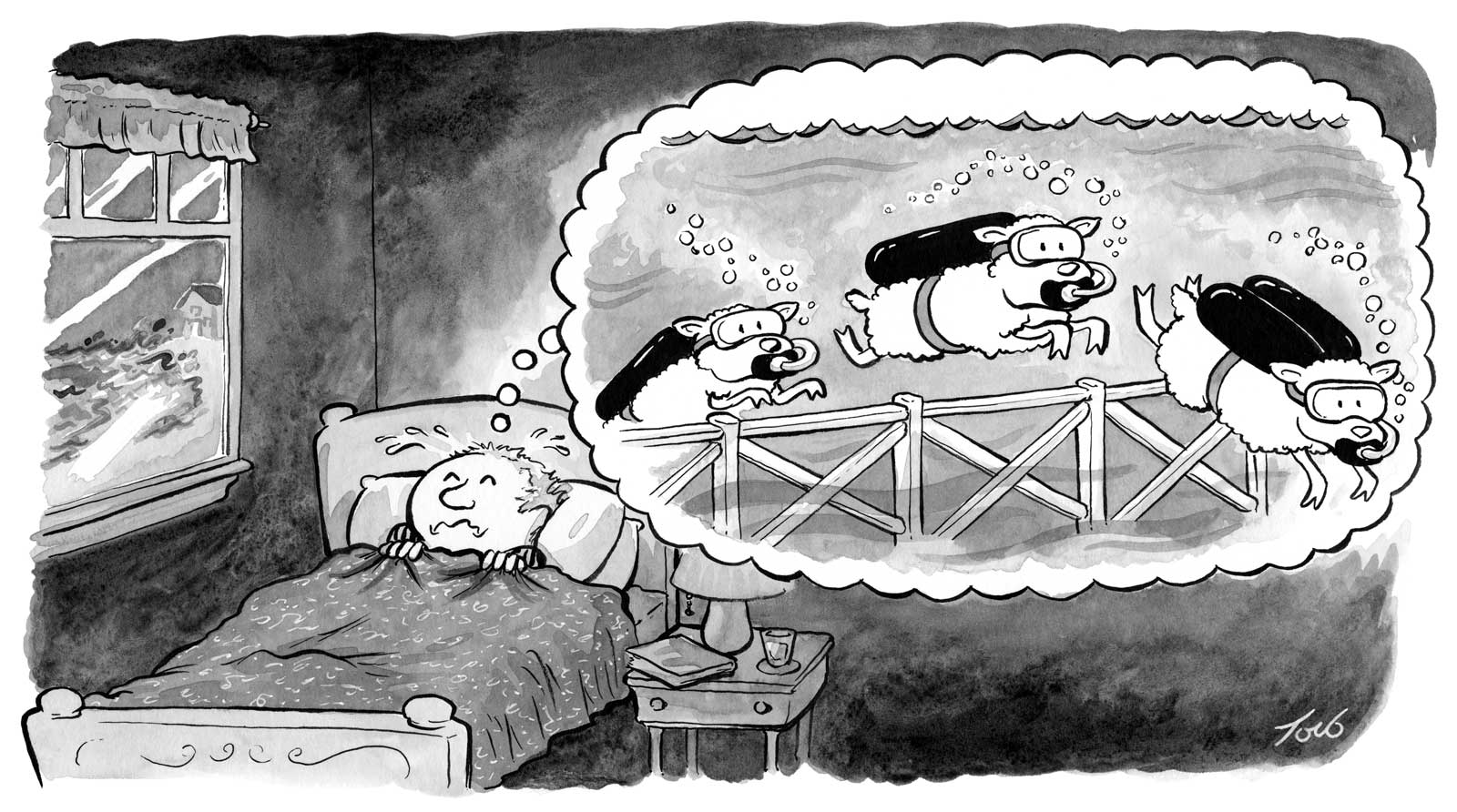

I live directly on the water in Connecticut, and I have been tormented over the threat of rising water levels for years. I have nightmares about it! I have been debating selling the house, though neither I nor my family truly wish to do so. I would prefer to stay put in this beautiful spot and hope that there is no significant risk to my property for another 50-100 years.

I will say that I have witnessed some routinely higher tides and many winter storms that surge well beyond what we would see 20-40 years ago. We also took big hits from hurricane Irene and Superstorm Sandy.

I have been paying around $5,000 per year for flood insurance, but I see this edging up each year. I fear a day will come after another bad hurricane when it starts becoming impossible to insure homes this close to the water.

It is understood that there is still debate about how much levels will rise and how fast this will occur. Further, I grasp that predictions may be impossible to accurately make. Nonetheless, I thought I would risk reaching out to get a sense of what someone with your expertise would say to someone like me in this situation.

— Claude in Connecticut

Dear Claude,

As a first step, you’ll need to get a clear sense of the future climate-related risks to your property. You can do so by typing in a U.S. address at Risk Factor, a free tool created by the nonprofit First Street Foundation.

Risk Factor assesses the potential for heat waves, wildfires, and flooding at specific U.S. properties during the next 30 years — in other words, the lifetime of a typical mortgage. Its flooding model includes variables such as the property’s elevation, potential rainfall and storm surge, and the location of nearby rivers. It also accounts for expected environmental changes, such as a rise in sea levels.

You were willing to share your street address with me, so I pulled up the risk rating for your home. The Risk Factor model deems the flood threat at your property as “Extreme” — with a 99% chance of flood water reaching your home at least once during the next 10 years.

The tool also estimates the costs of floodwaters entering the first floor. In your case, it predicts that a flood of up to six inches would cause $12,500 or more in damage.

Flood insurance costs

When water gets into your house, flood insurance often can help pay for repairs. But you noted that the cost of your flood insurance premium has been rising — and one expert recommends expecting more of the same.

“I would always plan for it to go up,” says Diane Ifkovic, Connecticut’s National Flood Insurance Program coordinator.

As sea levels rise, it’s possible that insurance companies may even drop some policies, Ifkovic says — especially for properties that become more “water” than “waterfront.”

Some property owners assume they’ll be able to build walls or take other measures to protect the land, but regulations may slow or prevent such work, she adds.

How ‘sunny day’ flooding could affect you

In addition to considering the potential consequences of extreme flooding, you’ll need to assess the risks of gradual increases in sea level rise, which could cause disruption and inconvenience in your community. Rising sea levels are already contributing to “sunny day” or “nuisance” flooding, in which salt water spills onto land even on beautiful, clear days. That water can damage the undersides of cars, force road closures, and temporarily shut down businesses.

The northeastern U.S. is expected to see 13.4 to 21.3 inches (0.34 to 0.54 meters) of additional sea level rise by 2050, according to a recent intermediate forecast from NOAA’S National Ocean Service. You can explore the areas of your community that would likely go underwater in that scenario by entering your address in the “Search places” box on the top right in Climate Central’s Coastal Risk Screening Tool. Adjust the water levels using the slider on the left-hand side of the page. Which roads are likely to go underwater? Which parks, beaches, or other favorite spots?

Assess your financial and personal situation

The next step is to think about your finances and what it would take to recover from a flood. Don’t assume that the federal government will bail you out after a disaster.

“That’s not really what happens. They just give you just enough money to kind of clean up your house,” Ifkovic says. “It’s never enough to make you whole.”

For Claude and other readers who already have flood insurance, consider these questions: Do you have the resources to continue paying that premium — even if it increases? In the event of a flood, would you be able to cover the deductible?

As the weather grows more unpredictable, Ifkovic recommends that even those who don’t live in a flood zone consider purchasing flood insurance — contrary to common belief, you don’t need to live in a flood zone to get a policy. And the premium likely won’t do much damage to your wallet: “It’s much cheaper if you’re not in a flood zone,” she says.

You’ll also want to take into consideration the potential costs of flood mitigation. Do you need to keep gutters cleaned, fix drainage problems, or invest in a sump pump and generator? Do you have the resources to elevate the home — or if that would cost too much, at least to elevate the utilities?

Finally, think about your other life factors. How long do you expect to remain in the home? Are you and others living in the home mentally and physically prepared to deal with the disruption that a major flood would cause?

Ultimately, you’ll need to make a personal decision: “It’s all your perspective on it,” Ifkovic says. “Can you bear losing that money?”

Update: As I was finishing the writing for this piece, I heard from Claude that he had decided to sell his home: “We are at peace,” he said by email. “We are shockingly OK with it now that we have made the decision.”

— Sara

Samantha Harrington contributed research.

Tom Toro is a cartoonist and writer who has published over 200 cartoons in The New Yorker since 2010.